Eps 2: Your card number is invalid.

In the podcast episode titled "Your card number is invalid," the speaker discusses the common issue of receiving a message that your card number is invalid when trying to make a purchase. The speaker explains that this can happen due to various reasons, such as entering incorrect information, using an expired card, or insufficient funds in the account. They emphasize the importance of double-checking the card details and contacting the bank for assistance. The speaker advises listeners to explore alternative payment methods and reminds them to stay calm and patient while resolving the issue.

| Seed data: | Link 1 |

|---|---|

| Host image: | StyleGAN neural net |

| Content creation: | GPT-3.5, |

Host

Elaine Freeman

Podcast Content

Introduction:

Welcome to our podcast where we discuss the importance of payment security and the increasing threat of invalid card numbers. In today's digital age, online transactions have become an integral part of our lives. However, this convenience comes with its fair share of risks, and one common issue faced by consumers is the invalidation of card numbers. Join us as we delve into the reasons behind this problem, its potential consequences, and ways to prevent it.

What is an Invalid Card Number?

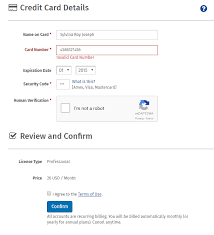

An invalid card number refers to a credit or debit card number that does not meet the specified criteria outlined by financial institutions. These criteria typically include the card's length, format, and a series of mathematical algorithms used for verification. In simple terms, it means the card details you're trying to use are incorrect, resulting in a failed transaction.

Reasons behind Invalid Card Numbers:

1. Typographical Errors: A common reason for an invalid card number is unintentional human error during manual entry. A single misplaced digit or an incorrect sequence can render the card unusable for transactions. This issue is particularly prevalent when ordering goods online or making purchases over the phone.

2. Expired Cards: As time progresses, credit and debit cards have expiry dates. After reaching this date, the card becomes invalid and no longer functional for transactions. Renewal processes must be undertaken to acquire a valid card and avoid inconvenience during transactions.

3. Stolen or Lost Cards: If a cardholder reports their card as stolen or lost, financial institutions automatically deactivate the card to prevent unauthorized transactions. Attempting to use such cards will result in an invalid card number error.

4. Billing Address Mismatch: When making online purchases, it is important to provide accurate billing information, including the address associated with the given card. Failing to provide the correct billing address often leads to an invalid card number error, as the information does not match the card issuer's records.

Consequences of an Invalid Card Number:

1. Failed Transactions: The primary consequence of an invalid card number is the inability to complete a transaction. Whether it's purchasing goods online, paying bills, or withdrawing cash from an ATM, a card number error can hamper your financial activities.

2. Delayed or Canceled Services: Invalid card numbers can often lead to delays or cancellations of important services. This could include difficulties in paying utility bills, subscriptions, or even hotel reservations.

Prevention and Solutions:

1. Accuracy in Card Details: Ensuring that you enter the card details accurately, especially during online transactions, can significantly reduce the chances of encountering an invalid card number. Double-checking before submission is vital to avoid potential errors.

2. Keep Track of Expiry Dates: Being aware of your card's expiry date lets you proactively plan its renewal. Regularly check the expiration date of your card, and make necessary arrangements well in advance to avoid any inconvenience.

3. Prompt Reporting of Lost or Stolen Cards: If you lose your card or suspect it has been stolen, promptly notify your card issuer so that they can deactivate the card, preventing unauthorized transactions from taking place.

4. Confirm Billing Address: When making online purchases, verify that the billing address provided exactly matches the address registered with your card issuer. This small step can prevent issues related to an invalid card number.

Conclusion:

While an invalid card number can be frustrating, understanding the reasons behind it and implementing preventive measures can help minimize the occurrence of such issues. By ensuring accuracy in card details, keeping track of expiry dates, promptly reporting lost or stolen cards, and confirming billing addresses, you can navigate the world of digital transactions with ease and security. Stay safe, stay informed, and protect your financial well-being.