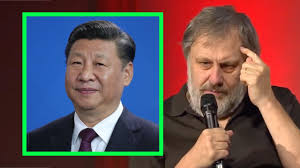

Eps 1: Why China is the future of Capitalism

— politics

| Host image: | StyleGAN neural net |

|---|---|

| Content creation: | GPT-3.5, |

Host

Lily Woods

Podcast Content

China has the second biggest number of Fortune 500 companies in the world and has billionaires more than Europe. Three of the five biggest Chinese companies on the earth are Chinese: Sinopec Group, State Grid and China National Petroleum. One only has to look to China to create a system with such immense global synergies and networking powers: Chinese companies, state banks, investors, and the Chinese Party and state.

China a innovated on the offensive side of the equation by deepening the integration of the Chinese Communist Party and the state into the corporate sector. This has increased China's share of equity income, which seems more concentrated in advanced market economies than in the West. The reason for China's sustained economic growth is that the reform process has succeeded in reducing the share of state-owned enterprises, not the other way around.

It is widely believed that China's success lies on the Third Way, a political and economic model that occupies the ground between capitalism and socialism. This newfound enthusiasm for other economic models did not lead to an immediate conversion to capitalism when China abandoned its planned economy to be a free market economy. But China has forced us to reassess how capitalism works and how the world should adapt to China's refusal to imitate the business practices of Western corporations.

Indeed, China's success is a clear demonstration of the power of capitalism. Should China regain greater influence in the market, it could maintain a moderate growth rate. Meanwhile, tensions between the state and capitalism in China will continue to increase and have an international impact.

At the same time, the Chinese government, like other political-capitalist states, must generate economic growth to legitimize its rule - a constraint that is becoming increasingly difficult to fulfill. A state-driven political model of capitalism as seen in China, but also in other parts of Asia such as Myanmar, Singapore and Vietnam privileges high economic growth while limiting individual political and civil rights. Strong administrative and informal control of finance by a state-dominated banking system provides a solid basis of authority to cool real-estate markets, manage rapid growth of shadow loans, stimulate the economy, and stabilize capital outflows from renmimbi.

Many experts around the world have pointed out that China's economy is likely to collapse. Countries "debt power has caused breakneck growth over the decades, endangering the economy, and the government is changing the rules. It has been suggested that the likelihood of China developing into an economic system similar to that of the United States is low, and will instead develop into an economic system similar to that of Germany or Japan.

Advocates of the belief that China is not innovative and that its technological progress is the product of massive theft of intellectual property by the West rely on a simple prejudice that China will use administrative regulations to force companies to hand over technology to businesses in China. China is also looking to build international institutions, such as the Asia Infrastructure Investment Bank, in the manner of the United States after World War II when it heads the World Bank and the International Monetary Fund. The United States should spend its time supporting Chinese initiatives that promote trade, foreign investment and infrastructure development in fast-developing countries without undermining their economic growth, just as US opposition to China's Belt and Road Initiative and the China-led AIIB.

While China refuses to publicize its own institutions, the West continues to promote the values of the liberal capitalism in China and large parts of the Chinese population are attracted to Western institutions. The greatest danger for China is that the Chinese themselves begin to believe what many people in the West think already: that China has discovered a special third way between capitalism and socialism and that economic success has been achieved not despite, but because of, the larger influence of the state. There is a good argument that many of the recent efforts of the Trump administration to make China more directing and determined to ensure that their companies dominate key technology resources at home and in global supply chains and restrict investment in key companies have convinced Xi that State capitalism is the best and most viable way forward.

The central control of Internet access limits the extent to which. China's large educated middle class can participate in the open exchange of information and ideas. Whether China becomes truly communist depends on its success in addressing a range of economic problems that will affect the future growth, standard of living and legitimacy of the Communist party. China is far more sophisticated and developed than what Deng inherited in the late 1970s. It thinks that China is the world's greatest growth engine and a better investment than the United States. One of the most pressing challenges for a Biden administration is China's competing urge to be a powerful and destructive state capitalist system that not only threatens US economic and strategic interests but also undermines the regulatory and legal structure that support the global economy.