Eps 2394: Velocity banking for paying off investment property mortgage

— The too lazy to register an account podcast

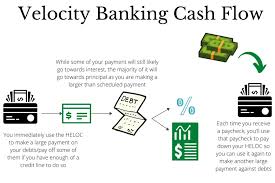

In this podcast episode, the concept of velocity banking is discussed as a strategy for paying off an investment property mortgage more quickly. The host explains that velocity banking involves using a line of credit to make extra payments towards the mortgage, allowing for faster debt reduction and interest savings. This method relies on leveraging available funds and maximizing cash flow to accelerate debt repayment and increase overall wealth. The host provides tips and advice on implementing velocity banking effectively to achieve financial goals.

| Seed data: | Link 1 |

|---|---|

| Host image: | StyleGAN neural net |

| Content creation: | GPT-3.5, |

Host

Rhonda Romero

Podcast Content

Velocity banking is a concept that involves leveraging your cash flow and available credit to accelerate the repayment of debts, such as mortgages, car loans, or student loans. By strategically managing your income and expenses, as well as utilizing lines of credit or other financial tools, you can potentially save thousands of dollars in interest payments and pay off your debts at a much faster rate.

When it comes to investment properties, paying off the mortgage quickly can increase your cash flow and overall return on investment. By reducing the amount of interest paid over the life of the loan, you can potentially save tens of thousands of dollars and build equity in the property much faster.

One of the key strategies in velocity banking is the use of a home equity line of credit (HELOC) or a personal line of credit to pay down the mortgage on your investment property. By using the line of credit to make extra payments towards the principal balance of the mortgage, you can significantly reduce the amount of interest that accumulates over time.

In addition, velocity banking involves strategically timing your payments and income to maximize the impact on your debt repayment. By making bi-weekly payments instead of monthly payments, you can reduce the amount of interest that accrues on the mortgage and pay off the loan more quickly.

It is important to note that velocity banking is not a "get rich quick" scheme and requires discipline, financial awareness, and understanding of your cash flow. It is crucial to have a solid understanding of your financial situation, income, expenses, and debts before implementing this strategy.

In conclusion, velocity banking can be a powerful tool for paying off an investment property mortgage faster and more efficiently. By leveraging your cash flow and available credit, and strategically timing your payments, you can potentially save thousands of dollars in interest payments and build equity in your property at a rapid pace. Thank you for tuning in to today’s podcast episode on velocity banking for investment properties. Stay tuned for more valuable insights and strategies for financial success.