Eps 1: transformer models that predict stock price and software used

— transformer and stock prediction models

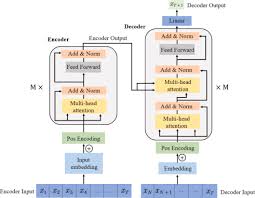

The podcast discusses the application of transformer models for predicting stock prices, highlighting their ability to handle sequential data and capture complex patterns in financial markets. It also covers various software tools and libraries used in implementing these models, such as TensorFlow and PyTorch, and emphasizes their importance in preprocessing data, training models, and evaluating performance. Practical challenges like overfitting, data quality, and computational requirements are mentioned, alongside potential solutions like data augmentation and model optimization techniques.

| Seed data: | Link 1 |

|---|---|

| Host image: | StyleGAN neural net |

| Content creation: | GPT-3.5, |

Host

Allison Lowe

Podcast Content

In practice, these transformer models require robust software tools for their development and deployment. Python reigns supreme with its array of deep learning libraries and frameworks like TensorFlow, PyTorch, and Hugging Face Transformers. TensorFlow, developed by Google, offers high-level APIs that facilitate the building, training, and fine-tuning of complex transformer models. PyTorch, favored for its dynamic computational graph and ease of use, is often the go-to choice for researchers and practitioners working with transformer models. Hugging Face's Transformers library has become indispensable for integrating pre-trained transformer models, providing an extensive repertoire of models specifically fine-tuned for various applications, including financial forecasting.

Moreover, the use of cloud computing platforms such as AWS (Amazon Web Services), Google Cloud, and Azure further streamlines the deployment of these sophisticated models. These platforms offer not only the computational power needed to train transformer models on enormous datasets but also services like SageMaker on AWS, which simplifies the entire machine learning workflow from data labeling to model deployment. Financial institutions harness these technologies to create predictive models that analyze historical price data, market trends, and even external socio-economic indicators to forecast stock prices with increasing accuracy.

Combining transformer models with ensemble techniques and other machine learning methods can also yield more robust predictions. For instance, merging the predictive power of transformers with traditional econometric models or recent advances in reinforcement learning can capture a more comprehensive view of market dynamics. This holistic approach offers a richer, multi-faceted analysis, often required for the volatile and complex nature of stock markets.

In essence, the synergy between advanced transformer models and sophisticated software and computing platforms represents a significant advancement in financial analytics. These tools not only enhance predictive accuracy but also enable a level of analysis that was previously unattainable, thereby offering traders and financial analysts a powerful edge in the highly competitive landscape of stock trading and investment.