Eps 1968: Lobby Law Compliance for Your Nonprofit Organization

— The too lazy to register an account podcast

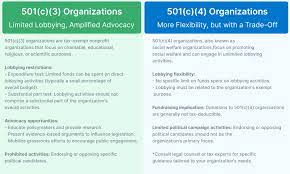

In the podcast episode titled "Lobby Law Compliance for Your Nonprofit Organization", the speaker discusses the importance of understanding and complying with lobby laws for nonprofit organizations. Lobbying refers to the act of attempting to influence government officials or policy decisions. The podcast highlights that while lobbying can be an effective way for nonprofits to advocate for their cause, it is essential to navigate the legal framework surrounding lobbying activities. Failure to comply with lobby laws can lead to penalties and potential loss of tax-exempt status. The speaker emphasizes the distinction between lobbying and advocacy, noting that advocacy is a broader term that encompasses activities such as public education and mobilization while lobbying specifically involves influencing public officials. They outline the different types of lobbying activities, including direct lobbying, grassroots lobbying, and election-related activities, each subject to specific rules and regulations. To ensure compliance, nonprofits are encouraged to familiarize themselves with the relevant laws, such as the Internal Revenue Code and the Lobbying Disclosure Act. The speaker suggests training staff and board members on these regulations, outlining reporting requirements, and maintaining proper records of lobbying activities. They also recommend using technology and software to simplify tracking and reporting efforts. The podcast emphasizes the importance of maintaining transparency in lobbying activities and keeping supporters and donors informed about the organization's engagement in these activities. Nonprofits are advised to have proactive communication and establish clear policies and procedures to ensure compliance and manage potential risks. Overall, the podcast emphasizes the significance of understanding and adhering to lobby laws for nonprofit organizations. It stresses the importance of compliance to maintain reputation, tax-exempt status, and effectively advocate for their cause.

| Seed data: | Link 1 |

|---|---|

| Host image: | StyleGAN neural net |

| Content creation: | GPT-3.5, |

Host

Sheila Griffin

Podcast Content

Introduction:

Welcome to today's podcast on Lobby Law Compliance for Your Nonprofit Organization. In our discussion today, we will explore the importance of understanding and adhering to lobby laws to ensure your nonprofit organization operates within legal boundaries. Lobbying plays a critical role in advocating for your organization's mission, and it is essential to be knowledgeable about the regulations and requirements to maintain transparency and accountability. So, let's delve into the world of lobby law compliance!

Importance of Lobby Law Compliance:

Lobbying is a vital avenue for nonprofit organizations to influence legislation, public policies, and decision-making processes. It allows them to advocate for their causes, raise awareness, and create meaningful change in society. However, lobbying activities come with a set of rules and regulations that vary across jurisdictions, making it crucial for nonprofits to be well-versed in lobby law compliance.

By adhering to lobby laws, organizations can safeguard their reputation and maintain the public's trust. Compliance ensures transparency in your lobbying efforts, showcasing that your organization operates ethically and responsibly. Failing to comply with lobby laws may result in severe penalties, including fines, loss of tax-exempt status, and damage to your organization's reputation. Therefore, understanding and complying with these laws is paramount for nonprofits.

Know Your Lobby Law:

To ensure compliance, nonprofits must familiarize themselves with the specific lobby laws of their jurisdiction. These laws outline various aspects, such as registration requirements, reporting obligations, and limitations on lobbying activities. Understanding these requirements will help your organization navigate the legal landscape and minimize potential risks.

Common Compliance Measures:

To comply with lobby laws, nonprofits can implement several measures. Firstly, registration is often a prerequisite for engaging in lobbying activities. This entails filing necessary paperwork, disclosing information about your organization, and paying any associated fees. Secondly, nonprofits must accurately track and report their lobbying activities, including expenditures and time spent on lobbying efforts.

Moreover, it is essential to differentiate between direct and grassroots lobbying, as they may have different compliance requirements. Direct lobbying involves advocating directly to lawmakers, while grassroots lobbying focuses on mobilizing the public to influence legislation. Both forms of lobbying might have distinct reporting thresholds and definitions under lobby laws, so understanding these distinctions is vital.

Building a Compliance Culture:

To ensure lobby law compliance, nonprofits should cultivate a culture of compliance within their organizations. This involves educating staff members about lobby laws, their implications, and the potential consequences of non-compliance. Providing training and resources on lobby law compliance can empower employees to navigate advocacy activities while remaining within legal boundaries.

Additionally, it is essential to establish internal controls and policies that promote accountability. These can include clear guidelines on acceptable lobbying practices, regular monitoring of lobbying activities, and adopting a proactive approach to compliance. Building a compliance framework demonstrates your organization's commitment to upholding the law and fosters a culture of transparency and integrity.

Engaging Lobbyists:

Nonprofits often engage professional lobbyists to enhance their advocacy efforts. While lobbyists can bring valuable expertise and connections, nonprofits must ensure they work with reputable individuals or firms who understand and comply with lobby laws. Conducting due diligence on potential lobbyists and drafting clear contracts that outline compliance expectations can help mitigate risks associated with non-compliance.

Conclusion:

In conclusion, lobby law compliance is a critical aspect of nonprofit organizations' advocacy activities. Understanding and adhering to lobby laws ensures transparency, credibility, and accountability in your lobbying efforts. By familiarizing yourselves with these laws, implementing compliance measures, and cultivating a culture of compliance, nonprofits can confidently engage in lobbying activities while avoiding legal pitfalls. So, stay informed, stay compliant, and continue making a positive impact in the world!