Eps 1: Investments Hrizon

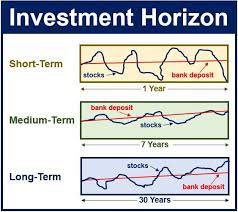

The podcast titled "Investments Horizon" discusses the importance of considering the long-term horizon when making investment decisions. The host explains that many investors focus on short-term gains, often resulting in unnecessary risks and losses. It is advised to take a more strategic approach, considering the time frame of investment goals and aligning them with the appropriate investment strategies. The podcast highlights the benefits of diversification, emphasizing the importance of spreading investments across different asset classes and sectors to mitigate risk. It also emphasizes the significance of regularly reviewing and rebalancing investment portfolios to ensure they remain aligned with investment objectives. Taking a long-term perspective and staying informed about market trends can help investors make better-informed decisions and achieve their investment goals.

| Seed data: | Link 1 |

|---|---|

| Host image: | StyleGAN neural net |

| Content creation: | GPT-3.5, |

Host

Jared Morris

Podcast Content

[Intro Music]

Host: Welcome back to a brand-new episode of Investments Horizon. I'm your host and financial expert, John Davis. In today's episode, we are going to delve into the ever-evolving world of investments and explore the various strategies that can help you navigate the complex financial landscape. So, grab your favorite cup of coffee and get ready to dive into this fascinating topic!

Segment 1: Understanding the Basics of Investments

Host: To kick off this episode, let's start with the basics of investments. Investing is the act of allocating money or resources with the expectation of generating a return or profit over time. The crucial principle to remember here is that investments involve risks. However, the key here is to strike a balance between risk and reward. While high-risk investments can yield significant returns, low-risk investments ensure stability and security.

Segment 2: Types of Investments

Host: Now that we have a clear understanding of the basics, let's talk about the different types of investments available. The most common ones include stocks, bonds, real estate, mutual funds, and cryptocurrencies. Each investment type has specific characteristics, potential returns, and risks associated with it. Diversification is the key to a successful investment portfolio. By diversifying across various asset classes, geographical regions, and industries, investors can reduce their exposure to risk.

Segment 3: Emerging Trends in Investments

Host: As the financial industry continues to evolve, new trends are constantly shaping the investment landscape. One emerging trend is impact investing, where investors allocate their funds towards companies that promote positive social or environmental change. This not only generates financial returns but also creates a lasting impact on society. Another significant trend is the rise of robo-advisors, digital platforms that use algorithms to provide personalized and automated investment advice. These platforms are changing the way investors manage their portfolios.

Segment 4: Strategies for Successful Investments

Host: Building a successful investment strategy involves careful planning and decision-making. One essential strategy is conducting thorough research before investing. Analyzing economic trends, industry growth potential, and company financials can help identify lucrative opportunities. Additionally, developing a long-term investment mindset is crucial. Historically, the stock market has shown consistent growth over time. Patience and discipline can be beneficial as short-term market fluctuations should not deter long-term investment plans.

Segment 5: Balancing Risk and Reward

Host: It is essential to strike the right balance between risk and reward when investing. Higher-risk investments such as stocks may offer greater potential returns, but they also come with significant volatility. On the other hand, lower-risk investments like bonds or real estate provide stability but may have comparatively lower returns. Finding the ideal mix based on personal financial goals, risk tolerance, and time horizon is crucial.

Segment 6: Seek Professional Guidance

Host: For those venturing into the world of investments for the first time, seeking professional guidance can be invaluable. Experienced financial advisors can provide personalized advice tailored to individual circumstances. They can help create a comprehensive financial plan, identify suitable investment opportunities, and provide ongoing portfolio management.

Host: Well, that brings us to the end of this episode of Investments Horizon. We hope you have gained valuable insights into the world of investments and are now better equipped to make informed financial decisions. Remember, investing is a journey that requires continuous learning and adaptation. Stay tuned for our next episode, where we will explore the role of technology in revolutionizing the investments landscape. Until then, happy investing!

[Outro Music]