Eps 2: currency rsi pair trading usd vs euro

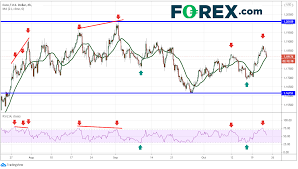

The 10-minute podcast titled "Currency RSI Pair Trading USD vs Euro" discusses the concept of Relative Strength Index (RSI) and its applications in pair trading between the US dollar (USD) and the Euro (EUR). The podcast explains how RSI is a momentum oscillator used by traders to identify overbought and oversold conditions in financial markets. Pair trading, on the other hand, involves simultaneously taking long and short positions on two correlated assets to capitalize on their price differences. The host emphasizes the importance of understanding RSI and its implications for pair trading, particularly when dealing with major currency pairs like USD and EUR. She explains that monitoring RSI levels can help traders identify potential trading opportunities, as extreme RSI readings often indicate a possible reversal in the currency pair's direction. Furthermore, the podcast provides an example of a pair trading strategy between USD and EUR based on RSI. It suggests that when the RSI of the USD/EUR pair reaches overbought levels, traders may consider opening a short position in anticipation of an imminent reversal. Similarly, when the RSI becomes oversold, opening a long position might be advantageous as a rebound could be expected. The podcast concludes by noting that while RSI can be a valuable tool in currency pair trading, it is still important to analyze other factors, such as market trends, news, and economic indicators, to make well-informed trading decisions.

| Seed data: | Link 1 |

|---|---|

| Host image: | StyleGAN neural net |

| Content creation: | GPT-3.5, |

Host

Vickie Pearson

Podcast Content

Introduction:

Welcome back to another episode of our podcast on the fascinating world of forex trading. In today's episode, we will be exploring the concept of currency Relative Strength Index (RSI) pair trading and its application to the USD versus the Euro. Currency pair trading is a popular strategy employed by forex traders, and the RSI indicator serves as a valuable tool for identifying potential trading opportunities. So, let's dive right in and explore the dynamics between the USD and Euro using the RSI indicator.

Understanding the RSI Indicator:

To grasp the concept of currency RSI pair trading, we need to understand the RSI indicator first. RSI, or Relative Strength Index, is a technical indicator used in forex trading to measure the strength and momentum of a financial asset. It oscillates between 0 and 100, where values above 70 indicate overbought conditions, and values below 30 signify oversold conditions. Traders typically use RSI to determine potential reversals or market trends.

Analyzing the USD-Euro Pair:

The USD and the Euro are two of the most widely traded currencies globally, making them an ideal pair to study for currency RSI pair trading. The RSI indicator helps traders identify overbought and oversold conditions in this currency pair. For instance, an RSI value above 70 may indicate that the USD is overbought against the Euro, suggesting a potential reversal or a drop in price. Conversely, an RSI value below 30 could signal overselling, indicating an opportunity for the USD to strengthen against the Euro.

Factors Affecting the USD-Euro Pair:

Several factors influence the dynamics between the USD and the Euro, which traders should consider when applying the RSI indicator for pair trading. Economic indicators such as GDP growth, interest rates, inflation, and political stability play significant roles. Additionally, news events, central bank interventions, and global macroeconomic trends may also impact the USD-Euro exchange rate. By keeping abreast of these factors and applying the RSI indicator, traders can identify potential opportunities for profitable trades.

Using RSI Pair Trading Strategies:

Currency RSI pair trading involves two primary strategies: mean reversion and trend-following. Mean reversion aims to exploit temporary price deviations from the average by buying undervalued assets and selling overvalued ones. In contrast, the trend-following strategy focuses on capitalizing on persistent trends by identifying overbought or oversold conditions.

Traders utilizing the mean reversion strategy in currency RSI pair trading might initiate a short position when the RSI value exceeds 70, expecting a price drop. Conversely, they would consider a long position when the RSI value falls below 30, anticipating a potential recovery or price increase. Trend-following traders, on the other hand, would follow the direction indicated by the RSI, either entering a long position during an upward trend or a short position during a downward trend.

Risk Management and Conclusion:

As with any trading strategy, risk management is crucial when engaging in currency RSI pair trading. Setting appropriate stop-loss orders to limit potential losses and adhering to a disciplined trading plan are essential steps to mitigate risks. Additionally, considering fundamental analysis alongside the RSI indicator can strengthen trading decisions.

In summary, currency RSI pair trading provides forex traders with valuable insights into the dynamics between various currency pairs, including the USD versus the Euro. By incorporating the RSI indicator into their analysis and applying effective trading strategies, traders can increase their chances of identifying profitable trading opportunities. Remember, thorough research, practice, and risk management are key to successful trading. Happy trading!