Eps 1238: Crowd equity

— The too lazy to register an account podcast

| Host image: | StyleGAN neural net |

|---|---|

| Content creation: | GPT-3.5, |

Host

Elaine Freeman

Podcast Content

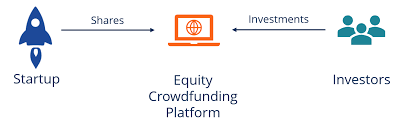

Equity crowdfunding gives startups the opportunity to raise more funds and gives the general public the chance to invest in their passionate projects and areas of interest without much effort. Equity crowdfunding allows inexperienced people to support community projects, and there are companies that seek funding that can use the appropriate platform to reach those who want to invest in equity crowdfunding.

Crowdfunding allows individuals and investors to get involved in start-ups and small businesses that are far from being listed, because anyone can buy a small amount of shares - market shares. It allows contributors to become part-owners of the company through trading in capital and equity, and provides an investment opportunity. This makes equity crowdfunding riskier than the potential crowdinvestment option.

Importantly, crowdfunding platforms offer new ways to invest in property, such as property investment funds. Similar to equity crowdfunding, the real estate crowdfunding platform offers investors several options and lower minimum amounts to invest in real estate.

Unlike general crowdfunding, equity crowdfunding offers participants the opportunity to become involved in a company. In other words, it is a great way for entrepreneurs and small business owners to raise money. Equity crowdfunding is very interesting for investors because you don't have to have too much capital. It allows investors to buy into companies they believe in and therefore have a greater stake in the company's success than a traditional crowdfunding platform.

There is no limit to how much money you can raise, although investors receive a certain amount of equity in the company in return for their money, as well as other crowdfunding rewards such as stock options, stock shares and other perks.

But crowdfunding allows the average investor to invest a much smaller amount in such ventures. Entrepreneurs can raise funds by borrowing from friends and family, applying for bank loans, appealing to investors or turning to private equity or venture capital firms. Equity crowdfunding is also a good option - for start-up entrepreneurs who are looking to finance a small business, such as a start-up, or a new business.

If you are planning to join a crowdfunding campaign, always make sure you do so as an investor, not as a donor. If you want to give crowdfunding investors a stake in your company, you need to secure equity financing from them. Equity-based crowdfunding, backed by companies such as FundersClub, is the right choice if you are hoping to raise a lot of capital in a round without traditional investors.

This means you need to give more money to get a fair valuation for a crowdfunding round. There are certain conditions that VC powers require, but the more reasonable the valuation and terms, the better and equity-intensive - crowdfunding offers are more likely to succeed and raise capital.

Moreover, many crowdfunding campaigns have a cap on how much capital a person can invest based on their income or net worth. Remember, too, that if there is no clear exit from the business, equity crowdfunding is appropriate and investors can make money from it. If a company is unable to raise money through its IPO or a private equity round, it can rely on crowdfunding as a way to make money. While there are a number of ways to buy or float on the secondary market, where you can easily sell your shares, the shares that make crowdfunding investments are highly illiquid.

With these provisions in mind, it is clear that equity crowdfunding does not just mean publishing a bid or raising capital on a website.

It is important to understand why equity crowdfunding offers entrepreneurs a different opportunity than stock market trading. Investing in stocks crowdfunding can give investors the opportunity to invest in blue chip or large cap companies. Investors in equity crowdfunding buy a product at a discount just a year before it is launched and make a profit once they make the best investment, regardless of which company they are investing in. They participate as if they bought the product Just years before publication at a discount, but do not make a profit until they have invested in this company. Equity crowdfunding investors acted as if they had bought the products at no discount and invested well.

Equity crowdfunding is the process of raising capital through a combination of crowdfunding platforms such as Kickstarter, Indiegogo and other similar platforms. Here is a list of the top crowdfunding investments for shares that you can look at when looking for your top crowdfunding investments.