Eps 2142: Create a banking app from scratch

— The too lazy to register an account podcast

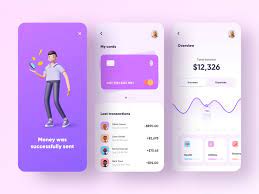

In the 10-minute podcast titled "Create a banking app from scratch," the host provides a step-by-step overview of how to develop a banking app. The host emphasizes the importance of thoroughly understanding customer needs and market trends before beginning the app development process. They also suggest conducting market research to identify potential competitors and their features. The podcast recommends starting with wireframes and creating a clear user interface (UI) design to ensure a seamless user experience. Choosing the right technology stack for the app, such as programming languages and frameworks, is also highlighted as a crucial step in the development process. Additionally, the host advises implementing security measures like encryption, two-factor authentication, and biometric authentication to protect user data. They stress the necessity of thorough testing to identify and fix any bugs or glitches before launching the app. The podcast concludes by emphasizing the importance of continuously monitoring user feedback and consistently updating and improving the app based on user needs and industry advancements.

| Seed data: | Link 1 |

|---|---|

| Host image: | StyleGAN neural net |

| Content creation: | GPT-3.5, |

Host

Randy Mitchelle

Podcast Content

Introduction:

Welcome to today's podcast where we'll be discussing the process of creating a banking app from scratch. In today's digital age, with the increasing reliance on technology, banking apps have become an essential tool for customers to manage their finances conveniently. In this podcast, we aim to provide you with valuable insights into the fundamental steps involved in developing a successful banking app, serving as a guide for aspiring developers, entrepreneurs, or anyone interested in understanding the intricacies of app creation.

Topic 1: Identifying the Requirements of a Successful Banking App

To create a successful banking app, the first step is to ascertain the requirements it should meet. Various factors need to be considered, such as optimal security measures, a user-friendly interface, compatibility with multiple platforms, and integration with core banking systems. Conducting thorough market research to understand the needs and expectations of potential users is crucial before initiating the app development process.

Topic 2: Design and User Experience

In this segment, we will explore the importance of designing an intuitive and visually appealing banking app interface. Creating a user-centric design that ensures ease of navigation is vital. Properly categorizing and presenting essential features, such as balance inquiries, transaction history, bill payments, and fund transfers, enhances the user experience. Integrating the design elements seamlessly across various devices and screen sizes is also crucial to provide a consistent user experience.

Topic 3: Security and Data Protection

As banking apps handle sensitive customer data, security should be a top priority during development. Implementing robust encryption techniques, two-factor authentication, and biometric authentication methods ensure the safety of user information. Conducting regular security audits and adhering to industry standards help in preventing unauthorized access, identity theft, and other security breaches.

Topic 4: Integrating Core Banking Systems

Integrating the banking app with the core banking systems is fundamental for seamless financial transactions. Establishing real-time connectivity between the app and the backend systems, such as account balance updates, transaction processing, and account management, is crucial for a banking app's functionality. Proper synchronization ensures that users have up-to-date information at their fingertips.

Topic 5: Testing and Quality Assurance

To ensure a seamless user experience and minimize the risk of issues, thorough testing and quality assurance are essential. Rigorous testing scenarios must cover functionality, usability, performance, and security aspects of the banking app. Conducting beta testing with real users and collecting their feedback can help identify any necessary improvements. Investing ample time in quality assurance contributes to the overall success of the app.

Topic 6: Compliance with Regulatory Standards

Building a banking app requires strict adherence to regulatory standards and compliance. Compliance with regulations such as KYC (Know Your Customer), data protection, and anti-money laundering measures is critical. Collaborating with legal and compliance experts ensures that the app meets all the necessary requirements outlined by regulatory bodies.

Topic 7: Deployment and Post-Launch Support

Once the banking app is developed and tested, it's time for deployment. Choosing the appropriate deployment method, such as app store or enterprise distribution, requires careful consideration. Post-launch support, including regular updates, bug fixes, and customer support, is crucial to keep the app running smoothly and address any issues that may arise over time.

Conclusion:

Creating a banking app from scratch is undoubtedly a complex and challenging process. By identifying user requirements, incorporating user-centric design, prioritizing security measures, integrating core banking systems, conducting thorough testing, maintaining regulatory compliance, and providing post-launch support, developers can create an exceptional banking app. We hope that this podcast has provided you with valuable insights, empowering you to venture into the exciting world of app development and bring forth innovative financial solutions.