Eps 652: Alternative credit data solutions

— The too lazy to register an account podcast

Alternative credit data looks beyond conventional credit bureau data, which typically focuses on credit activity such as credit card, mortgage, and auto lending.

The use of alternative credit data is not a new concept in consumer credit assessment.

When alternative credit data is combined with advanced analytic models, it produces a credit assessment that is both highly predictive and strongly uncorrelated with traditional credit scores.

Host

Louella Weaver

Podcast Content

Alternative data for credit scoring comes from various sources and is usually traded in relation to 12 months or longer. Examples of alternative credit data include credit ratings, credit reports and other forms of credit reporting. Consider traditional data as a set of results that are typically compared to the average credit score of the entire credit market. An example is the average value of a single credit card.

Many of the alternative credit data can be collected in the traditional way by asking the consumer. Whether or not alternative credit information is used for valuation depends on the information collected by the company.

Lenders can ask consumers to provide them with access to alternative credit information such as credit card numbers, credit history and other information. These include credit scores, income, employment status, education level, age, marital status and more.

Try to change your credit card number, credit card history and other information about yourself, such as your income, employment status, education level, age, marital status.

The big idea behind using alternative data is to go beyond traditional scoring models and apply more expansive criteria to better qualify credit - invisible consumers. The new data could also help others who have what the industry calls a "thin credit file" or "invisible credit file," such as those without a credit history. Faced with growing pressure from lenders to expand the population to which they can offer loans, companies are helping to collect alternative credit data from what some call "invisible" credit files, or those that have no history of credit card use or other forms of information.

TransUnion also has its own alternative data product, Trended Credit, but says risk strategies are evolving. As Experian says, it can offer a more holistic view of consumers by using new data sources, including credit card usage, credit history and other information.

Alternative credit data is often used as a buzzword to describe financial data, but it is a broad term for data that comes from consumers that is not overly mentioned in mainstream credit reports. Other revealing details include a person's income and employment history when they apply for other alternative financial services from a person with a disability.

In particular, bringing together these peripherals can help to paint a picture of what someone is responsible for, and whether they may have experienced one or two financial setbacks. One of the most important aspects of alternative data is the ability to assess creditworthiness in the context of a person's financial situation, not just in terms of their credit history.

A growing trend among lenders, particularly in the financial services industry, is the use of alternative data, especially data on individual behavior, to make decisions about whether or not to lend.

According to Experian, 65% of lenders say they already use information from traditional credit reports to make lending decisions. FICO uses data from the credit report, including alternative data, to calculate credit ratings and help lenders predict how risky it would be to lend to them. Higher scores show lenders that you're more likely to pay off your debt in full on time than lower scores.

Many use alternative credit data to develop credit ratings, and this can have many benefits. It can provide forward-looking help when a person does not have access to traditional credit accounts, such as when there is no historical data.

In addition, alternative credit data can help to establish a precise scoring process for all types of applicants. It can be complementary for many consumers with expanded portfolios, and it can help to develop personal apps for financial assistants for people with limited access to traditional credit information.

By using alternative data to collect thin credit files from consumers, lenders can offer these services to their customers. If you do not have access to traditional credit information such as bank account numbers, credit values or credit history, alternative data may be the only way to obtain a loan.

CoreLogic has developed a number of solutions that aim to exploit the opportunities of alternative credit data and implement tools designed to deliver alternative data in real time, high quality and low cost in minutes. Read more about how Intellias is built and how it works in our new blog post about the alternative credit data solution CoreLogics.

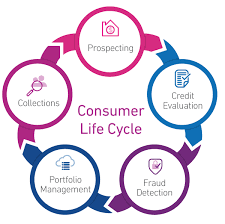

CoreLogic, the world's leading provider of credit monitoring and analysis data, has introduced the new Corelogic Teletrack platform, providing lenders and lenders with access to a wide range of alternative and alternative data solutions for credit management and risk management. With Intellias now added to the platform, CoreLogics Teletsrack customers can now access alternative data from a variety of sources, including credit ratings, credit reports, credit history and other data sources. This helps users discover new market segments, make smarter risk decisions, increase their business across the credit life cycle, improve services, and much more.