Eps 2000: AI for financial servicies

— The too lazy to register an account podcast

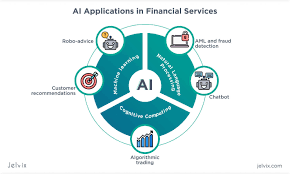

In a 10-minute podcast titled "AI for Financial Services," the speaker explores the increasing use of artificial intelligence (AI) technology in the financial industry. It begins by highlighting how AI is transforming various aspects of financial services, such as fraud detection, risk assessment, customer service, and investment management. The podcast emphasizes the role of machine learning algorithms in these applications, where AI systems can analyze abundant data to identify potential fraudulent activities or predict market changes. This allows financial institutions to proactively protect their customers' interests and make informed investment decisions. Moreover, AI is revolutionizing customer service in financial services, enabling chatbots and virtual assistants to interact with customers, provide prompt answers, and assist with simple transactions. This technology enhances customer satisfaction and reduces operational costs for financial institutions. The podcast also emphasizes the importance of ethical considerations and regulation in AI adoption. As AI becomes more prevalent in financial services, establishing responsible and transparent practices becomes crucial. The need for explainability of AI decisions and ensuring that biases are addressed are key challenges that need to be addressed. The speaker concludes by discussing the potential of AI in shaping the future of financial services. With continued advancements, AI has the capability to revolutionize the industry further, enabling personalized financial recommendations, customized product offerings, and improved user experiences. Overall, the podcast highlights how AI is transforming financial services by enhancing fraud detection, risk assessment, customer service, and investment management. It underscores the ethical considerations and regulation required for responsible AI adoption while exploring the potential for further advancements in the future.

| Seed data: | Link 1 |

|---|---|

| Host image: | StyleGAN neural net |

| Content creation: | GPT-3.5, |

Host

Heather Johnston

Podcast Content

In recent years, Artificial Intelligence (AI) has emerged as a game-changing technology across various industries. One sector that has truly benefited from AI is financial services. With its ability to process large amounts of data at incredible speed and accuracy, AI has transformed the way financial institutions operate. This podcast will delve into the applications of AI in financial services and explore the advantages it offers to both institutions and consumers.

One of the significant applications of AI in financial services is risk assessment and fraud detection. Traditional methods of identifying fraudulent transactions or assessing credit risk were manual and time-consuming. However, AI algorithms can now analyze vast amounts of data, including transaction histories, customer behavior patterns, and external factors, to detect suspicious activities. By employing machine learning techniques, AI systems continually improve their accuracy in identifying potential risks, allowing financial institutions to proactively prevent fraud and minimize losses.

Additionally, AI-powered chatbots have revolutionized customer service in the financial industry. Gone are the days of long wait times and frustrating phone calls when customers have queries or need assistance. AI chatbots can understand natural language and provide personalized responses, making customer interactions more efficient and seamless. These chatbots can quickly handle routine inquiries, such as account balance checks or transaction history, freeing up human resources to focus on more complex tasks. The availability of 24/7 customer support through AI chatbots has greatly enhanced customer satisfaction and loyalty.

Moreover, AI is reshaping investment and trading practices in the financial industry. AI-powered systems can analyze vast amounts of financial data, market trends, and news in real-time, making informed investment decisions. Machine learning algorithms can identify patterns and correlations that human traders may overlook, enabling more accurate predictions of market movements. Automated trading algorithms, or robo-advisors, relying on AI, can execute trades swiftly and efficiently, eliminating human emotions, which often lead to biased decision-making. This increased reliance on AI-driven trading systems has not only improved investment performance but has also made the financial markets more accessible to smaller investors with limited capital.

Another promising application of AI in financial services is personalized financial advice and recommendations. By leveraging AI algorithms, financial institutions can analyze individuals' financial data, spending patterns, and goals to offer tailored recommendations for budgeting, saving, or investment strategies. Such personalized advice can greatly assist customers in making informed financial decisions and achieving their financial objectives. AI-driven financial advisors can continually adapt and learn from customer feedback, providing even more fine-tuned recommendations and guidance over time.

However, as with any technological advancement, there are challenges and concerns surrounding the use of AI in financial services. The primary concern revolves around data privacy and security. AI systems rely on vast amounts of customer data to learn and make accurate predictions. Financial institutions must ensure robust security measures to protect customer information from any potential breaches. Additionally, the development and deployment of AI systems require skilled professionals who can understand and interpret the outputs. This calls for further investments in talent acquisition and training to fully leverage AI's potential in the financial sector.

In conclusion, the integration of AI in financial services has brought about numerous benefits and advancements. From risk assessment and fraud detection to personalized financial advice, AI is revolutionizing the financial industry. By harnessing AI's capabilities, financial institutions can provide better customer service, make more informed investment decisions, and offer personalized financial advice. However, addressing concerns around data privacy and security, as well as ensuring skilled professionals are available, is crucial for the successful implementation of AI in the financial sector. As technology continues to evolve, it is evident that AI will continue to shape and transform the future of financial services.